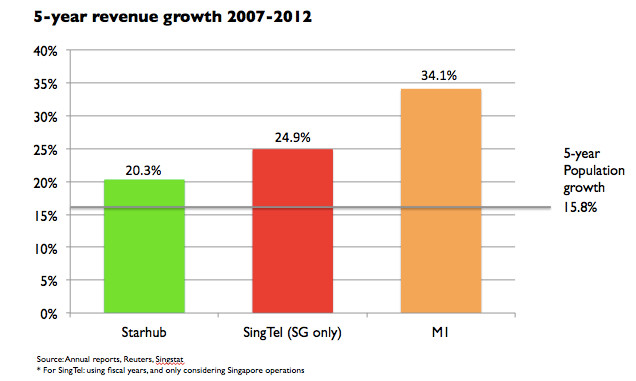

In Singapore, the three major telco players have done pretty well in the past 5 years, all chalking up over 20% revenue growth from 2007 to 2012 (see chart). In comparison, mature single market telcos like AT&T have chalked up a mere 7% revenue growth in the same period, while others face declining top-line.

Less people = less subscribers

However, if you take into account the population growth of Singapore over the same time period, it's clear that a significant part of their revenue growth has been supported by the population growth spurt in the past 5 years, at 15.8% growth for Singapore. For comparison, the same figure for the US is 4.2%.

However, this population growth 'bonus' is set to shrink dramatically. If we assume a 6.9Mn population by 2030, and assuming linear growth, the population will only grow 7.5% of the next 5 years. More likely though, the population will be controlled to a lower range - a 6.3Mn population by 2030 would mean just 4.9% growth over the next 5 years.

Just further bad news

The likely absence of this population 'bonus' in the coming years is just more bad news for Singapore telcos, who have to face the already tough industry challenges.

Like other mature market telcos, the only viable growth product is mobile data, which unfortunately cannibalises core revenues from voice and SMS. On the cost-side of the equation, there's significant outlay required to upgrade their networks to support the seemingly endless demand for more data.

Worst for Singapore-only telcos

SingTel might face a slightly better outlook, given it's diversified operations regionally, in particular India/Africa through Airtel and Indonesia through Telkomsel.

Singapore-only players like M1 and Starhub will likely suffer most. The market still values them as growth companies, with P/E ratios in the high teens - 18X for M1 and 20X for Starhub, on the back of their historical performance. The next 1-2 years will be critical for them to live up to this expectation and sustain their large market caps - SGD$2.7Bn for M1 and SGD$7.3Bn for Starhub. At this point though, I don't see any good options for them to pull this off.